- New independent report from Aurora Energy Research shows that hydrogen can meet up to half of Great Britain’s (GB) final energy demand by 2050, providing an important pathway to reaching UK’s ambitious Net Zero targets.

- The report concludes that both blue hydrogen (produced from natural gas after reforming to remove carbon content) and green hydrogen (produced by using power to electrolyse water) are expected to play an important role, providing up to 480TWh of hydrogen, or c.45% of GB’s final energy demand by 2050.

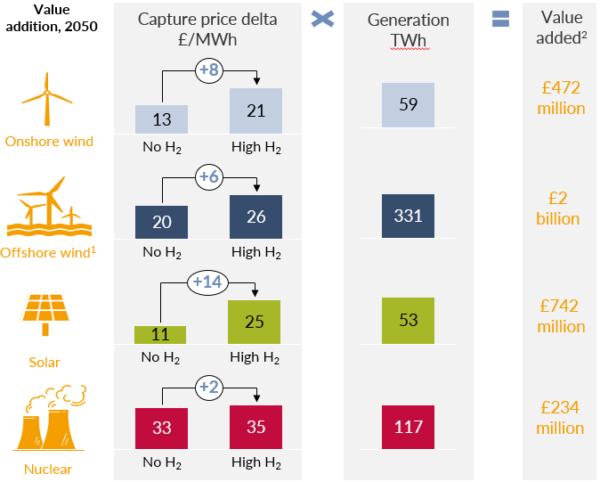

- All Net Zero scenarios require substantial growth in low-carbon generation such as renewables and nuclear. Large-scale hydrogen adoption could help to integrate renewables into the power system by reducing the power sector requirement for flexibility during peak winter months, and boosting revenues for clean power generators by c. £3bn per year by 2050.

- The rollout of hydrogen could accelerate green growth and enable the development of globally competitive low-carbon industrial clusters while utilising UK’s competitive advantage on carbon capture.

- In facilitating the identification of a cost-effective hydrogen pathway, there are some low-regret options for Government to explore, including the stimulation of hydrogen demand in key sectors, the deployment of CCS in strategic locations and the standardisation of networks. These initiatives could form an important part of the UK Government’s post-COVID-19 stimulus plan.

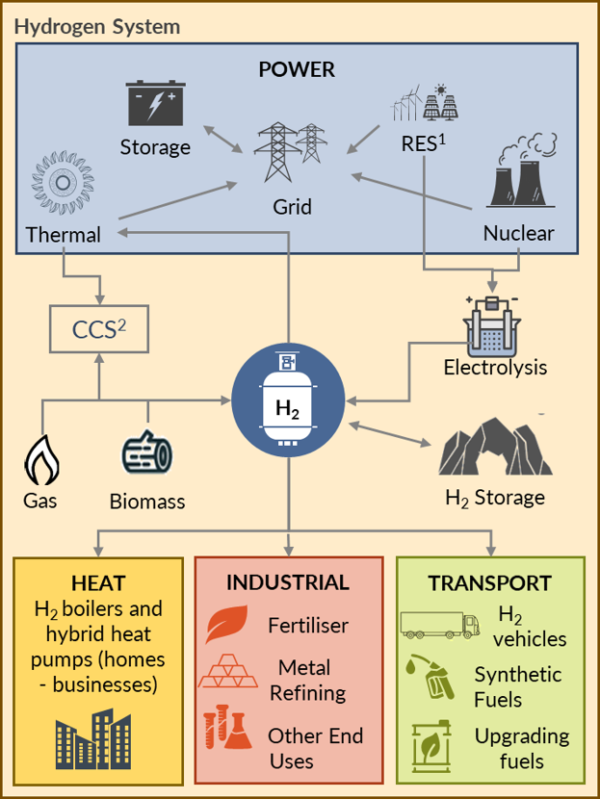

The UK has set a challenging target for Net Zero emissions by 2050, which requires switching energy consumption across the different sectors of the economy to zero-carbon sources. As is illustrated in Figure 1, hydrogen could play an important role in reducing emissions across all sectors with direct applications in heat, transport and industry.

FIGURE 1 THE POTENTIAL ROLE OF HYDROGEN IN THE ENERGY SYSTEM

Aurora Energy Research, the leading energy market analytics firm, has today published a major report (Hydrogen for a Net Zero GB: an integrated energy market perspective) into the role of hydrogen as a key enabler to the decarbonisation of our energy system. This builds on an analytical framework that integrates the entire market-based energy system and includes different types of production, transportation and storage technologies. The report provides a wide range of plausible Net Zero market outcomes by assessing various scenarios and sensitivities, reflecting alternative pathways for low-carbon power and hydrogen adoption.

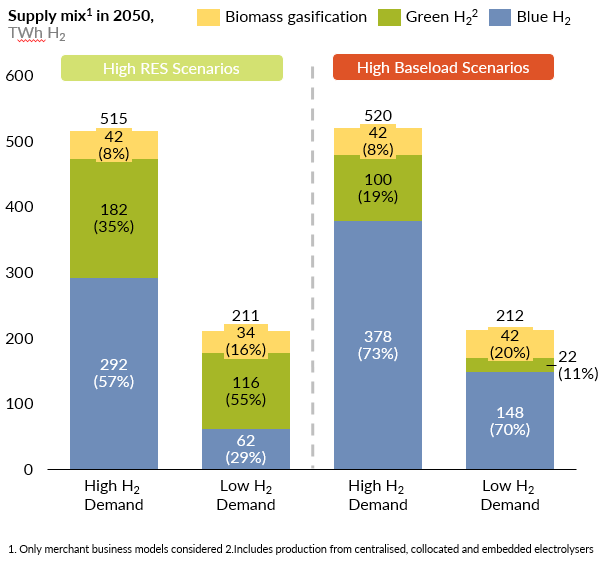

The analysis shows that by 2050, hydrogen could meet up to half of GB’s final energy demand by 2050, providing a total of more than 500TWh of hydrogen demand in a high adoption scenario. The scale of hydrogen demand across the economy is an important factor that will shape the relative share of blue and green hydrogen, as is illustrated in Figure 2. If deployment is limited to hard-to-electrify sectors, like steel and chemicals, supply from green hydrogen using low-carbon power can meet a significant part of the demand. However, widespread adoption could mean the deployment of up to 14 million hydrogen boilers and more than 75% hydrogen penetration in heavy-goods vehicles. This would necessitate the deployment of blue hydrogen technology using natural gas with carbon capture and storage (CCS) to provide the required scale of supply.

The relative share of green and blue hydrogen will also depend on the availability of cheap power. Deployment of green hydrogen will be driven by the amount of surplus low-carbon generation and cheap power available for electrolysis, which will depend on the policy direction and other developments in the power sector.

FIGURE 2 HYDROGEN SUPPLY MIX IN 2050 (TWH H2 )

All Net Zero scenarios require substantial growth in low-carbon generation such as renewables and nuclear, and electrification upon which hydrogen benefits are complementary in challenging sectors. Hydrogen could provide multiple benefits to the power sector, with increasing capture price and revenues for clean power generators by c. £3bn per year by 2050 (see Figure 3), and a reduction in the power sector requirement for flexibility during peak winter months.

FIGURE 3 VALUE ADDITION TO CLEAN-POWER GENERATORS IN 2050

Falling technology costs and gas prices will drive steady reduction in the market hydrogen price, which is expected to go below £50/MWh of hydrogen by 2050 (in real £2019, including production and transportation costs). Hydrogen storage in salt caverns can provide security of hydrogen supply in most years, but additional strategic reserve capacity of up to 7GW will be required to ensure system adequacy during extended scarcity periods.

All Net Zero scenarios require intensive policy development and investment across all energy sectors, which amounts to over £450 billion in net present value terms. No pathway (high hydrogen or electrification) is decisively better in terms of total system cost. Generally, hydrogen scenarios require additional investments on hydrogen transmission and distribution infrastructure and present higher energy costs, but lower spending on low-carbon power subsidies, power network costs and power capacity market spending.

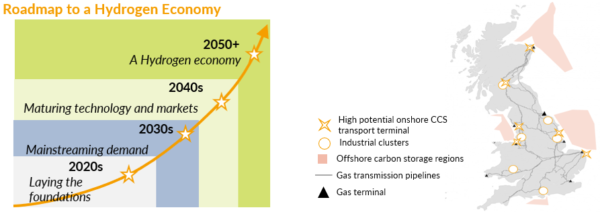

However, the implication of the report is that a hydrogen pathway could boost UK’s industrial competitiveness, with economic benefits in areas where there are fewer economic opportunities. Specifically, it would enable the development of globally competitive low-carbon industrial clusters, particularly around Humber and Teeside (see Figure 4). It will also utilise UK’s comparative advantage on blue hydrogen and CCS due to the availability of usable carbon storage, which could make the UK a leader in terms of hydrogen production costs until merchant green hydrogen becomes competitive in 15-20 years.

FIGURE 4 THE ROADMAP TO A HYDROGEN ECONOMY BY 2050 AND THE GEOGRAPHY OF INDUSTRIAL CLUSTERS, GAS AND CCS INFRASTRUCTURE IN GB

Finally, the report identifies multiple policy options for policy to anticipate challenges and tackle key uncertainties in the short term, including setting decarbonisation targets and promoting hydrogen demand in key sectors, deploying CCS in strategic locations and advancing energy efficiency and network standardisation efforts. In the medium and long term, policy focus would need to shift to harmonising markets and accelerating cost reductions.

Felix Chow-Kambitsch, Head of Commissioned Projects – Western Europe, Aurora Energy Research commented:

“As part of its post-COVID stimulus plan, the UK Government should consider policies towards meeting their commitments of Net Zero emissions. Stimulating the development of hydrogen infrastructure in the UK could facilitate the low-carbon energy transition as part of the UK’s efforts to hit its Net Zero target and unlock opportunities across UK industry and transport. Hydrogen could eventually meet up to 50% of total energy needs – across power, heating, industry and transport. The accelerated deployment of low-carbon power generation will enable utilities to create hydrogen from surplus power, while carbon capture technology enables the decarbonisation of natural gas and provides the required scale to the hydrogen sector. Unlocking the benefits of a hydrogen economy will require early support from Government, systematic changes to our energy system and significant investment by the private sector.”

Media contact

Caroline Oates

Marketing and Media Associate

E: caroline.oates@auroraer.com

T: +44 (0)1865 952700

M:+44 (0)7912 568570

Notes to editors

Aurora Energy Research is a leading independent European energy market analytics company founded in 2013 by University of Oxford professors and economists. Aurora provides deep insights into European and global energy markets supported by cutting edge models to help our clients navigate the global energy transition and make bankable investment decisions. We work with world leading organisations across Europe, including energy companies, financial institutions and governments. Our services include: subscription-based forecasts, reports, forums and bespoke consultancy services. Aurora Energy Research has offices in Oxford, Berlin and Sydney.